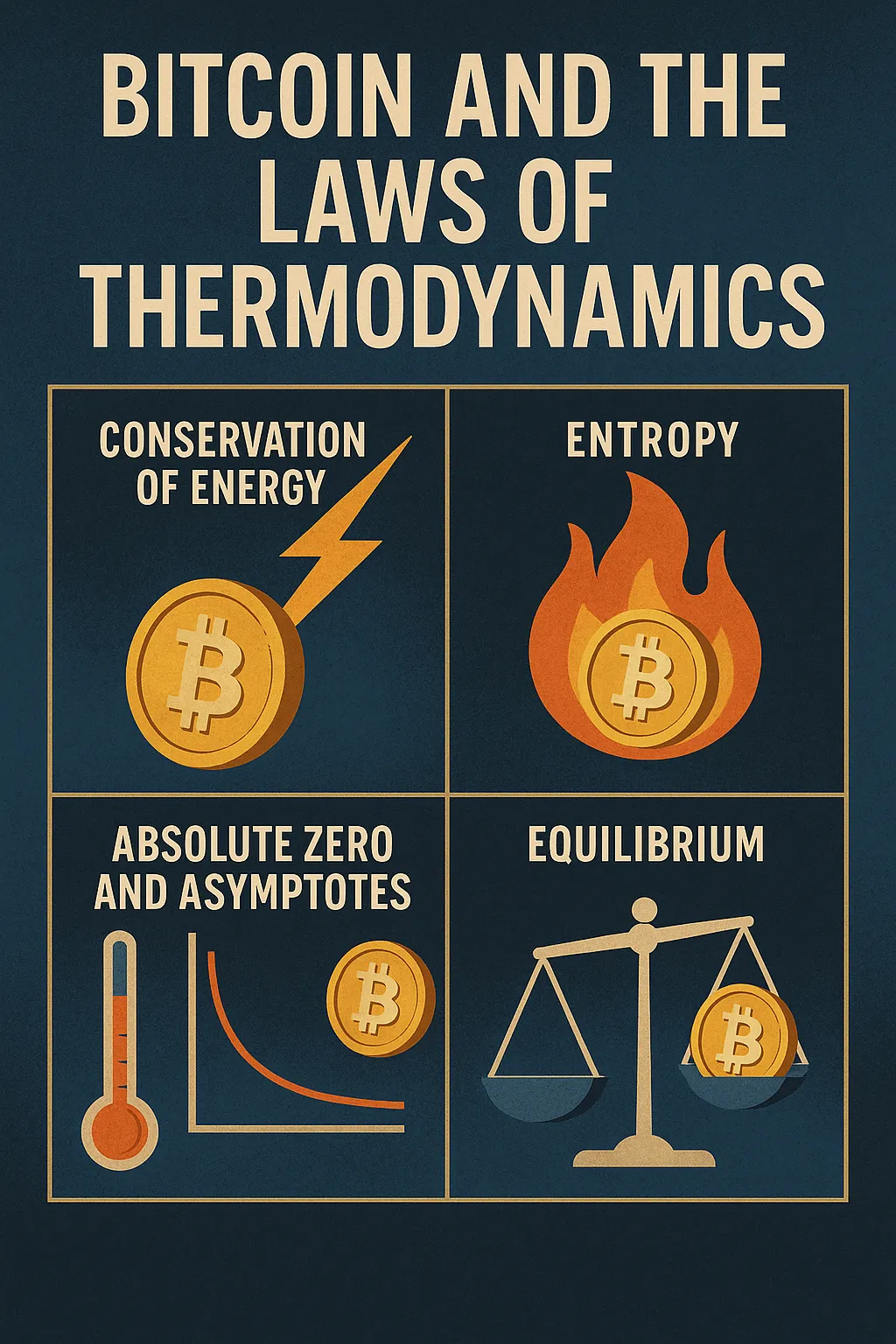

Bitcoin and the Laws of Thermodynamics

Physics doesn’t bend for politics, and energy doesn’t lie. That’s why Bitcoin, at its core, is not just computer code or financial speculation — it is thermodynamics expressed as money.

To grasp Bitcoin fully, we have to understand it not only as a monetary revolution but as a direct application of the fundamental laws of energy and entropy. Bitcoin is what happens when human beings harness physics to solve the problem of trust in money.

The First Law: Conservation of Energy

The First Law of Thermodynamics states that energy cannot be created or destroyed — only transformed.

In practice, this means all systems are bound by physical reality. You can’t get something for nothing. There is no perpetual motion machine, no free lunch.

This principle underpins why Bitcoin mining makes sense. Bitcoin is forged through Proof of Work, a process that transforms raw electrical energy into digital scarcity. Miners expend energy to perform computations, securing the network and validating transactions.

Just as no physical object can appear without energy input, no new Bitcoin can exist without the transformation of energy. This is not a metaphor. It is literal physics applied to money.

Why This Matters

Fiat currency ignores the First Law. Central banks “create” money with keystrokes, as though value can emerge from nothing. But inflation reveals the truth: new money dilutes old money. Energy wasn’t conserved, so purchasing power bleeds away.

Bitcoin fixes this by rooting monetary creation in the First Law. Every satoshi is a crystallized unit of energy expenditure. No energy, no coin.

The Second Law: Entropy and Irreversibility

The Second Law of Thermodynamics tells us that entropy — disorder — always increases in an isolated system. Processes move from order to disorder, and this direction cannot be reversed without cost.

This law explains why time feels like it flows in one direction, why your coffee cools down, and why you can’t uncrack an egg. Entropy is the arrow of time.

Bitcoin embodies this principle in two ways.

1. Proof of Work as Irreversible Cost

When a miner solves a block, the energy burned is gone forever. It cannot be reclaimed or reversed. That irreversibility is what makes Bitcoin secure. To attack the network, an adversary would have to replicate the same immense energy cost — entropy ensures the difficulty.

Each block in the chain is like a layer of entropy cement. Once hardened, it cannot be undone without colossal cost. This is why Bitcoin is often called “time-stamped energy.”

2. Fiat as an Entropy Cheat

By contrast, fiat currency is an attempt to cheat entropy. Central banks try to conjure order (new value) out of disorder (money printing), without paying the energy cost. The result is not free value but systemic instability. Inflation, asset bubbles, and financial crises are entropy asserting itself.

Why This Matters

Bitcoin doesn’t cheat entropy. It harnesses it. Proof of Work acknowledges that all order requires cost. Every coin is a permanent record of energy spent. This is why the network is unforgeable and why its history cannot be rewritten.

The Third Law: Absolute Zero and Asymptotes

The Third Law of Thermodynamics states that as a system approaches absolute zero, entropy approaches a constant minimum. In other words, there are limits that can never be reached.

This has a striking parallel with Bitcoin’s monetary policy. The supply of Bitcoin asymptotically approaches 21 million. Each halving event reduces the issuance of new coins, but it never reaches absolute zero until the final block reward ends around the year 2140.

Like the Third Law, Bitcoin sets a boundary condition: an unbreakable asymptote. No matter how much demand rises, no matter how much miners compete, the total supply will never exceed 21 million.

Why This Matters

Fiat has no such boundary. Its supply expands without limit, always moving away from order and stability. Bitcoin sets a thermodynamic floor — scarcity locked in code, mirroring nature’s limits.

The Zeroth Law: Equilibrium and Trust

The often-overlooked Zeroth Law of Thermodynamics establishes that if two systems are each in equilibrium with a third system, they are in equilibrium with each other. It’s the foundation for measuring temperature consistently.

Bitcoin reflects this through consensus. Each node independently verifies the blockchain. If node A and node B both agree with the Bitcoin protocol, they are in equilibrium with one another. Consensus is the equilibrium state of the monetary system.

This is what makes Bitcoin trustworthy without central authority. The network’s equilibrium is enforced not by decree but by physics-like consistency.

Bitcoin as a Thermodynamic System

Put these together, and Bitcoin itself resembles a thermodynamic system:

Energy input (First Law): Electricity powers mining. Energy is conserved but transformed into secure digital records.

Entropy (Second Law): Work performed is irreversible, ensuring security and immutability.

Asymptotic scarcity (Third Law): Supply approaches 21 million like a physical constant, never to be exceeded.

Equilibrium (Zeroth Law): Consensus ensures balance and trust across the network.

Bitcoin isn’t just “like” thermodynamics. It is a digital expression of it.

Why Physics Anchors Money

For centuries, money was tethered to physics. Gold was scarce because it was physically hard to extract and impossible to counterfeit. Fiat broke that tether, pretending political will could override physical law.

Bitcoin restores it. It takes the physical laws of thermodynamics and weaves them into the foundation of digital money. This is why Bitcoin cannot be inflated, censored, or corrupted. It is not politics. It is physics.

The Human Element: Aligning with Nature

Civilizations that align with physics thrive; those that defy it collapse. You can’t build an economy on perpetual motion machines or infinite printing presses. The system will break.

Bitcoin offers an alignment. By rooting money in energy and entropy, it creates a system as resilient as the laws of nature. It is money that reflects reality, not illusions.

And in a world increasingly filled with illusions — derivatives of derivatives, trillions of printed dollars, promises without backing — that matters more than ever.

The Bottom Line

The laws of thermodynamics aren’t abstract physics lectures. They’re the most fundamental rules of existence. And Bitcoin is the first monetary system built to obey them.

Fiat pretends you can get something for nothing.

Bitcoin proves that value requires energy.

Fiat tries to cheat entropy.

Bitcoin records it permanently.

Fiat expands without limit.

Bitcoin has hard-coded boundaries.

Fiat relies on trust in authority.

Bitcoin relies on equilibrium through proof.

Bitcoin isn’t just new money. It’s physics money.

Shout out to BullishBTC.com – where energy meets money, and thermodynamics meets freedom.