Am I Too Late for Bitcoin? Why the Answer Is Still No

“I’m too late for Bitcoin.”

That’s what people said when it hit $1,000. They said the same at $10,000, at $50,000, and again when it crossed $100,000. Each time, that feeling of being “too late” was really just a reflection of human psychology: we anchor on the past price instead of recognizing the future potential.

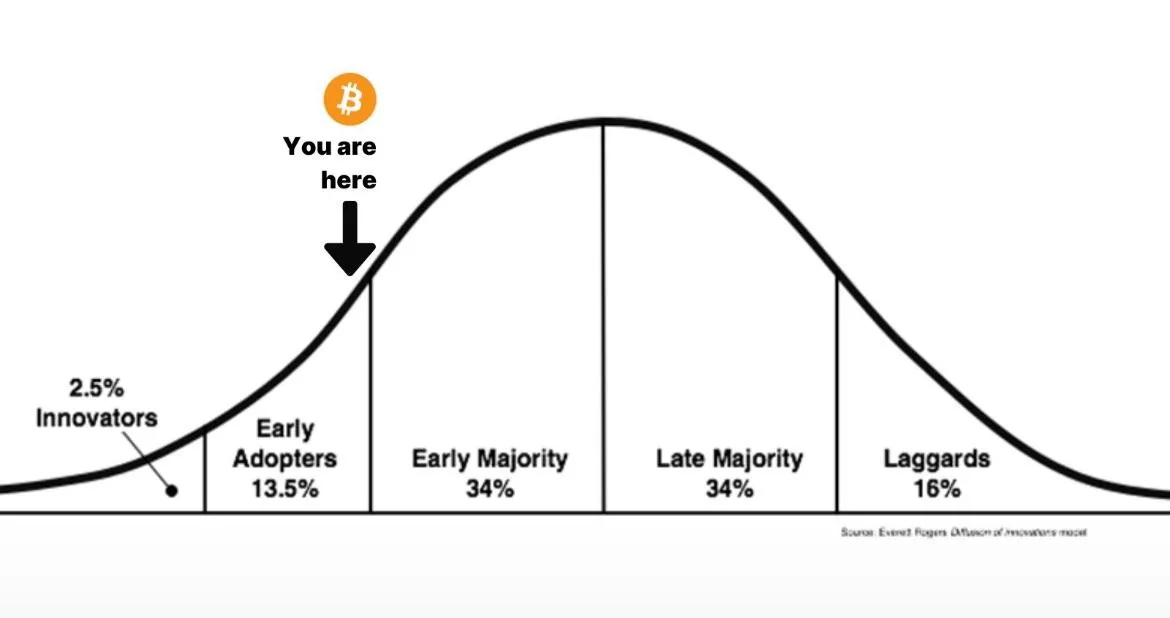

The truth is, Bitcoin adoption is still in its early chapters.

The Illusion of Being Late

People feel late because they compare themselves to early adopters. They see the stories of people who bought in 2013 or mined coins on a laptop in 2011 and think, “That could’ve been me.” But let’s be real—almost no one would have held through the wild ride. Most would have sold too early, spooked by volatility.

Being “early” isn’t just about buying first. It’s about having conviction when the rest of the world still doubts. And that opportunity is still alive today.

Every Tech Shift Feels Late… Until It Doesn’t

Think about the internet in the late 1990s. By then, Amazon was already public, AOL was everywhere, and “dot-com” had become a household phrase. Many people thought they had missed the boat. But back then, only about 5% of the world was online.

Today, more than 65% of the world uses the internet daily. The internet didn’t stop growing at 5%. It exploded into the most transformative technology of our lifetime.

Bitcoin adoption is tracing the same curve. Except this time, it isn’t just another app or website—it’s money itself.

Why the Serious Players Are Only Just Arriving

In the last few years, we’ve watched sovereign wealth funds, nation-states, and Fortune 500 companies step into Bitcoin. Insurance firms, pension funds, and banks are finally exploring custody and exposure. This is institutional validation that was completely absent a decade ago.

The big players are not late. They’re early in a different phase of the cycle: the global adoption phase. And that should tell you everything.

Money Has No Ceiling

With Bitcoin, the “upside” isn’t capped by a product category like smartphones or streaming services. Money is the biggest market of all. Every human being on the planet uses it. Every government manages it. Every business depends on it.

Bitcoin is not just a new asset. It is an entirely new monetary standard—a digital, neutral, borderless, incorruptible form of money. If it succeeds, it will touch every transaction, every bank, every balance sheet.

That is not priced in yet.

You’re Not Too Late—You’re Just Comfortable

If you feel like you’re too late, it may be less about the price and more about inertia. It’s easier to stay in old models, to trust the dollar, to assume the system will keep working. It feels safer to stay comfortable.

But comfort is the enemy of progress. Every new technology looks risky until it looks inevitable. Bitcoin is no different.

The difference is, you still have time.

Final Word

So, are you too late for Bitcoin? Not even close. We’re still early. The serious adoption wave is only beginning. The curve still has decades to run.

The real question isn’t “Am I too late?”

The real question is: “How long will I wait to catch up?”