The Foundations of Bitcoin: A 30-Year March Toward Monetary Sovereignty

Bitcoin did not emerge from thin air.

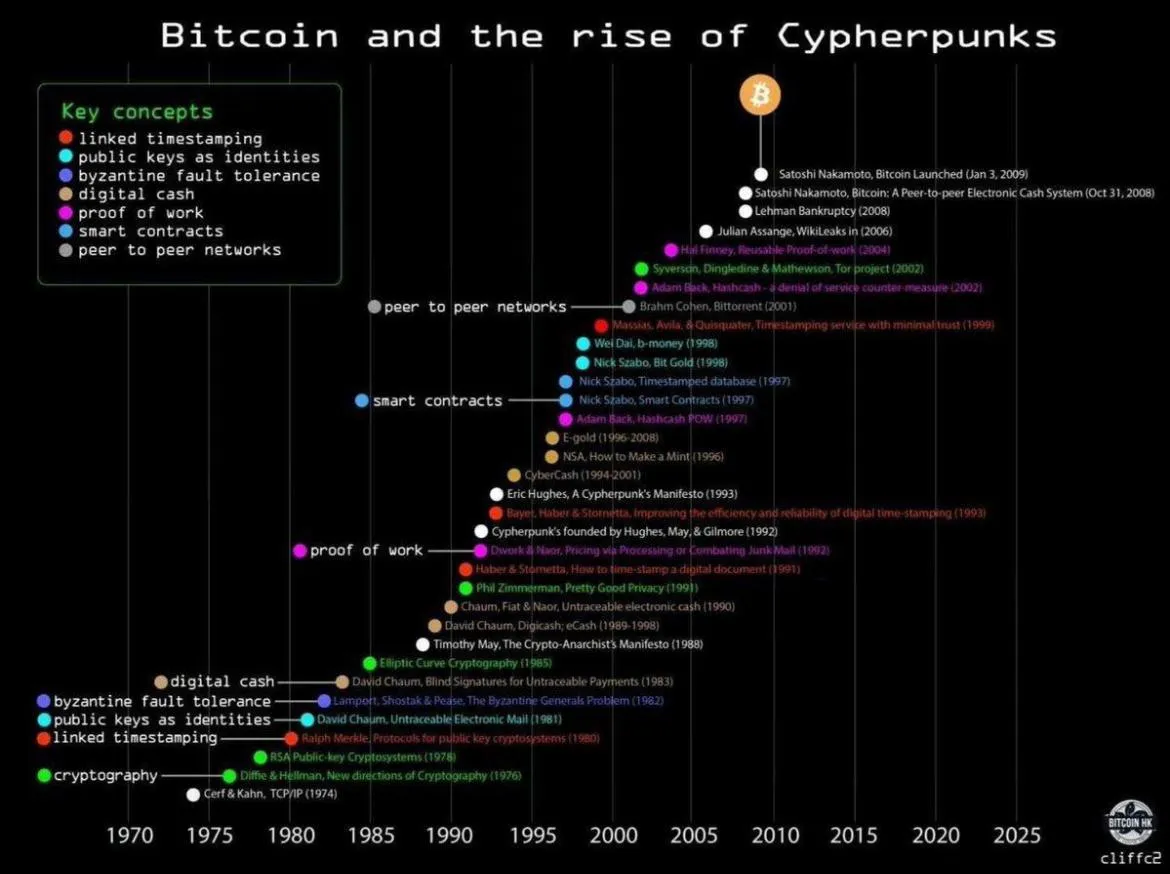

It was not the sudden spark of a lone genius but rather the culmination of decades of technological development, philosophical groundwork, and cryptographic innovation. The path to Bitcoin is the story of the Cypherpunks, a global movement of technologists, cryptographers, economists, and privacy advocates who understood the dangers of digital surveillance, broken money, and centralized control long before the rest of the world caught on.

This article explores the key breakthroughs that led to Bitcoin — from public key cryptography to digital cash, smart contracts to proof-of-work. These innovations span over three decades and collectively form the foundation of the most important monetary invention of the 21st century.

1970s: Cryptography as the New Frontier

The 1970s laid the intellectual groundwork for secure digital communication. Though these breakthroughs were theoretical at the time, they would later form the spine of the digital privacy revolution.

1974 — TCP/IP Protocol

Vinton Cerf and Bob Kahn developed the Transmission Control Protocol and Internet Protocol (TCP/IP). This was the bedrock of all internet communication, enabling decentralized information exchange across global networks.

1976 — Diffie-Hellman Key Exchange

Whitfield Diffie and Martin Hellman introduced a new method for exchanging cryptographic keys over an open channel. This was the birth of public key cryptography and a complete departure from the previous need for trusted intermediaries.

1978 — RSA Encryption

Ron Rivest, Adi Shamir, and Leonard Adleman introduced RSA encryption. This allowed for secure communications and the use of digital signatures, two essential components that would later be used in Bitcoin transactions.

These innovations made it possible to establish trust through mathematics rather than institutions.

1980s: The First Glimpse of Digital Cash

In the 1980s, personal computers became more common, and visionaries began imagining money that could be transferred electronically while preserving user privacy.

1981 — David Chaum’s Anonymous Communications

David Chaum published a groundbreaking paper proposing anonymous digital communication. He introduced the concept of "blinding" — a cryptographic technique that would later underpin digital money.

1983 — Blind Signatures for Digital Payments

Chaum followed up with a design for privacy-preserving digital cash using blind signatures. This allowed banks to issue electronic money that could be spent anonymously, mimicking the privacy of physical cash.

1989 — DigiCash

Chaum launched DigiCash, a company built to commercialize his cryptographic digital money. Although DigiCash eventually failed, it was a crucial step forward and inspired a generation of developers.

1985–1991 — ECC and PGP

Elliptic Curve Cryptography (ECC) was introduced in 1985 and would later be used in Bitcoin’s key pair system. In 1991, Phil Zimmerman released Pretty Good Privacy (PGP), bringing military-grade encryption to the public.

The dream of private, decentralized, digital cash was beginning to take form.

1990s: Enter the Cypherpunks

The 1990s witnessed the rise of the Cypherpunk movement — an informal network of programmers, academics, and activists who viewed cryptography as a tool for social and political change.

1992 — The Cypherpunk Mailing List

Founded by Eric Hughes, Timothy May, and John Gilmore, the mailing list became the beating heart of the movement. Developers openly discussed privacy tools, censorship resistance, and financial independence.

1993 — A Cypherpunk’s Manifesto

Eric Hughes wrote, “Privacy is necessary for an open society in the electronic age.” The manifesto encouraged action through software rather than political lobbying. The message was clear: build tools, not arguments.

1993 — Digital Timestamping

Stuart Haber and W. Scott Stornetta introduced linked timestamping, a way to cryptographically prove the existence of data at a certain time. Their work directly influenced the design of the blockchain.

1994 — Nick Szabo and Smart Contracts

Szabo proposed "smart contracts," or programmable agreements enforced by code. This concept would eventually expand into Ethereum, but the core idea — automated trustless execution — also influenced Bitcoin’s scripting language.

1997 — Bit Gold

Szabo later developed Bit Gold, a digital asset that used proof-of-work and timestamping to create unforgeable costliness. It came very close to Bitcoin but lacked a decentralized consensus mechanism.

1997 — Adam Back’s Hashcash

Designed to fight email spam, Hashcash required computational effort before sending a message. Satoshi Nakamoto would later adapt this idea into Bitcoin’s mining algorithm.

The Cypherpunks weren’t waiting for permission. They were building the future of freedom, one protocol at a time.

2000s: The Tools Are in Place

By the early 2000s, the essential components of Bitcoin existed, even if no one had yet combined them all.

2001 — BitTorrent

Bram Cohen released BitTorrent, demonstrating that peer-to-peer networks could function at scale without a central server. This showed the world what decentralized data sharing could look like in practice.

2002 — The Tor Project

Originally developed by the U.S. Navy, Tor allowed for anonymous browsing and communication. Tor became a key component in the privacy infrastructure surrounding Bitcoin and other decentralized tools.

2004 — Hal Finney’s Reusable Proof-of-Work

Hal Finney expanded on Hashcash by creating a system where proof-of-work tokens could be reused as digital money. Although centralized, this was a critical bridge between spam-prevention and decentralized currency.

2008 — Financial Crisis and Collapse of Trust

When Lehman Brothers collapsed and banks received taxpayer bailouts, the public’s faith in fiat money and centralized finance was severely shaken. The time was right for a new kind of money — one that could not be manipulated by governments or bankers.

2009: Bitcoin Goes Live

On January 3, 2009, the first Bitcoin block was mined. Embedded in the Genesis Block was the message:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

This was not just a technical launch. It was a political statement.

Bitcoin brought together every prior innovation — timestamping, digital signatures, proof-of-work, peer-to-peer networking, and cryptographic scarcity — and made them functional, secure, and decentralized.

The revolution had begun.

How the Puzzle Pieces Fit Together

Bitcoin did not invent most of its components. Instead, it combined them into a new architecture that solved a previously unsolved problem: how to achieve decentralized consensus about money without trusting any third party.

Linked Timestamping from Haber and Stornetta became the basis for Bitcoin’s blockchain.

Digital Signatures from RSA and ECC provided secure ownership of funds.

Proof-of-Work from Hashcash protected the network and controlled issuance.

Public Key Cryptography made trustless verification possible.

Peer-to-Peer Networks like BitTorrent and Tor enabled global participation without central servers.

Smart Contracts informed Bitcoin’s scripting features.

Digital Cash Concepts from Chaum and Finney laid the foundation for what money could be online.

Every piece was battle-tested before Satoshi combined them.

The Philosophy Behind the Technology

More than just code, Bitcoin was the expression of a philosophy: that people should not have to trust governments, corporations, or banks with their money.

The Cypherpunks saw what was coming — mass surveillance, financial censorship, and digital overreach. Their response was to write code that protected privacy and empowered individuals.

Satoshi Nakamoto's true genius was to understand not only the technology but the social moment. Bitcoin was released at the exact time when public trust in institutions was at a historic low.

The idea that “code is law” was no longer theory. It was running software.

Conclusion: Why This History Still Matters

To understand Bitcoin is to understand its history.

Every innovation it uses was a response to a problem — from centralized control to surveillance to double-spending. Every failed attempt before it taught a lesson that became part of Bitcoin’s DNA.

Bitcoin was not built in a vacuum. It is the product of decades of work by thousands of minds. Cryptographers, academics, hackers, and idealists all played a role.

It is not just a protocol. It is the final form of a movement that chose sovereignty over submission, privacy over convenience, and truth over trust.

That’s what gives Bitcoin its strength. Not just math. Not just code. But a legacy of freedom, encoded in software that anyone can run.

The next chapter of this story belongs to those who understand where it began — and what’s at stake if we don’t protect it.

Want to explore more about Bitcoin’s roots?

Download our free guide, “Bitcoin Unlocked: A Guide to Financial Freedom,” and join our learning community today: https://bullishbtc.com