How to Buy Your First Bitcoin (Without Getting Scammed or Overwhelmed)

So you’ve heard about Bitcoin.

Maybe it was from a podcast. Or a friend who can’t stop talking about it. Or maybe it’s just that lingering feeling that the financial system isn’t built for people like you—and Bitcoin might be your way out.

But when you actually try to buy some?

It feels like a maze.

Too many apps. Too many scams. Too many ways to mess up.

This guide is here to cut through the noise. No hype. No jargon. Just a simple path to buy your first Bitcoin safely and confidently.

First, Know What You’re Buying

You’re not buying a stock. You’re not gambling on a meme coin.

You’re buying a small piece of a decentralized monetary network that can’t be manipulated, inflated, or shut down.

You don’t need to buy a whole Bitcoin. You can buy a fraction—called satoshis (or sats). There are 100 million sats in 1 Bitcoin.

Start small. $5, $20, $50—whatever gets you comfortable. This is about learning first, not investing big.

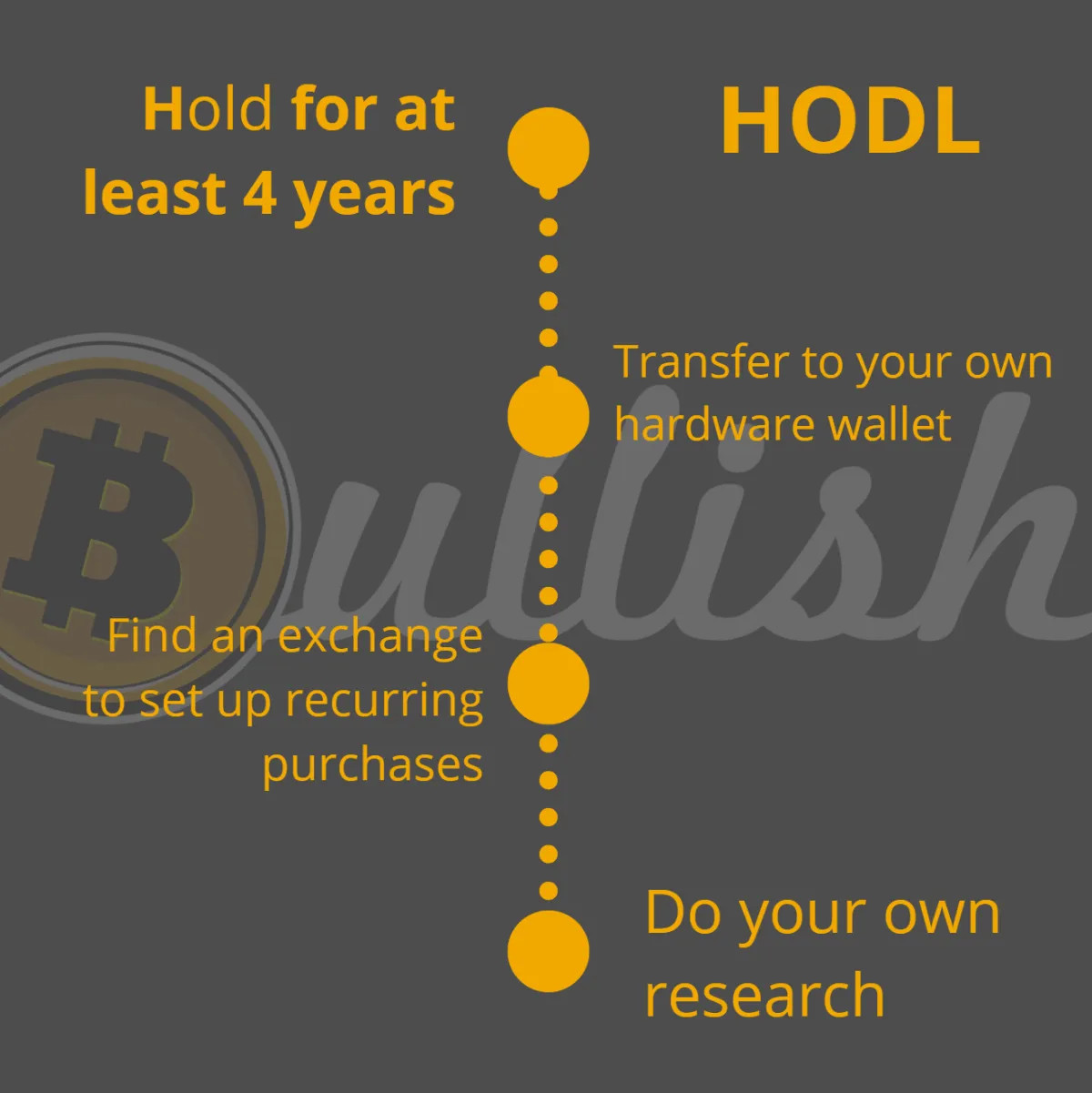

Step 1: Pick the Right Platform

Not all Bitcoin platforms are created equal. Many flashy apps offer crypto, but you want a platform that focuses on Bitcoin only, with high security, solid support, and a reputation for transparency.

Here are three great options (U.S.-based):

Swan Bitcoin – Easy recurring buys, Bitcoin-only, high security

River – Great for fast bank transfers, clean UI, Bitcoin-only

Strike – Best for small buys and peer-to-peer payments using Lightning

Avoid sketchy exchanges or platforms that bombard you with dozens of coins. You don’t need crypto. You need Bitcoin.

Step 2: Buy a Small Amount

Once you’ve signed up, verified your account, and connected a bank, start with a small buy.

Even $10 is enough to get your feet wet. The goal isn’t to “make money”—it’s to learn how Bitcoin works.

This first buy is your test flight. Think of it like getting your first driver’s license. Don’t rush. Don’t stress. You’re early.

Step 3: Take Self-Custody (Eventually)

When you buy Bitcoin on an app, it’s stored in a wallet they control. This is fine at first—but it’s not real ownership.

As the saying goes:

Not your keys, not your coins.

Eventually, you’ll want to move your Bitcoin to your own wallet. That’s called self-custody—and it’s one of the most powerful parts of Bitcoin.

Recommended beginner wallets:

BlueWallet (mobile, easy to use)

Phoenix Wallet (Lightning-friendly, great UX)

Blockstream Green (extra security, two-factor options)

Coldcard or Trezor (hardware wallets for serious long-term holding)

You don’t have to do this right away. But it’s worth learning once you have more than you’d want to lose.

Step 4: Save Your Seed Phrase

When you set up a wallet, it gives you 12 or 24 secret words—called a seed phrase. This is your backup. If you lose your phone or hardware wallet, these words can restore your Bitcoin.

Do not:

Take a screenshot

Save it in your phone

Email it to yourself

Do:

Write it on paper

Store it offline in a secure place

Consider a metal backup if holding larger amounts

Your seed phrase = your money. Treat it like gold.

Step 5: Zoom Out

Bitcoin isn’t about getting rich overnight. It’s not about timing the market.

It’s about opting out of a broken system that punishes savers and rewards speculation.

When you hold Bitcoin, you’re storing your time, your labor, your energy—without trusting a central bank or government.

You’re taking back control.

So don’t stress the price. Don’t obsess over the news. Just keep learning, keep stacking, and keep thinking long-term.

Final Thoughts

Buying your first Bitcoin can feel scary. That’s normal. Every Bitcoiner was once where you are now—confused, skeptical, nervous.

But once you take that first step, something clicks. You start to see money differently. You ask better questions. You realize you’re not just buying Bitcoin…

You’re buying back your future.

Need help getting started?

Download our free guide: Bitcoin Unlocked: A Guide to Financial Sovereignty

Shout out to BullishBTC.com—making Bitcoin simple, step-by-step, for everyday people.