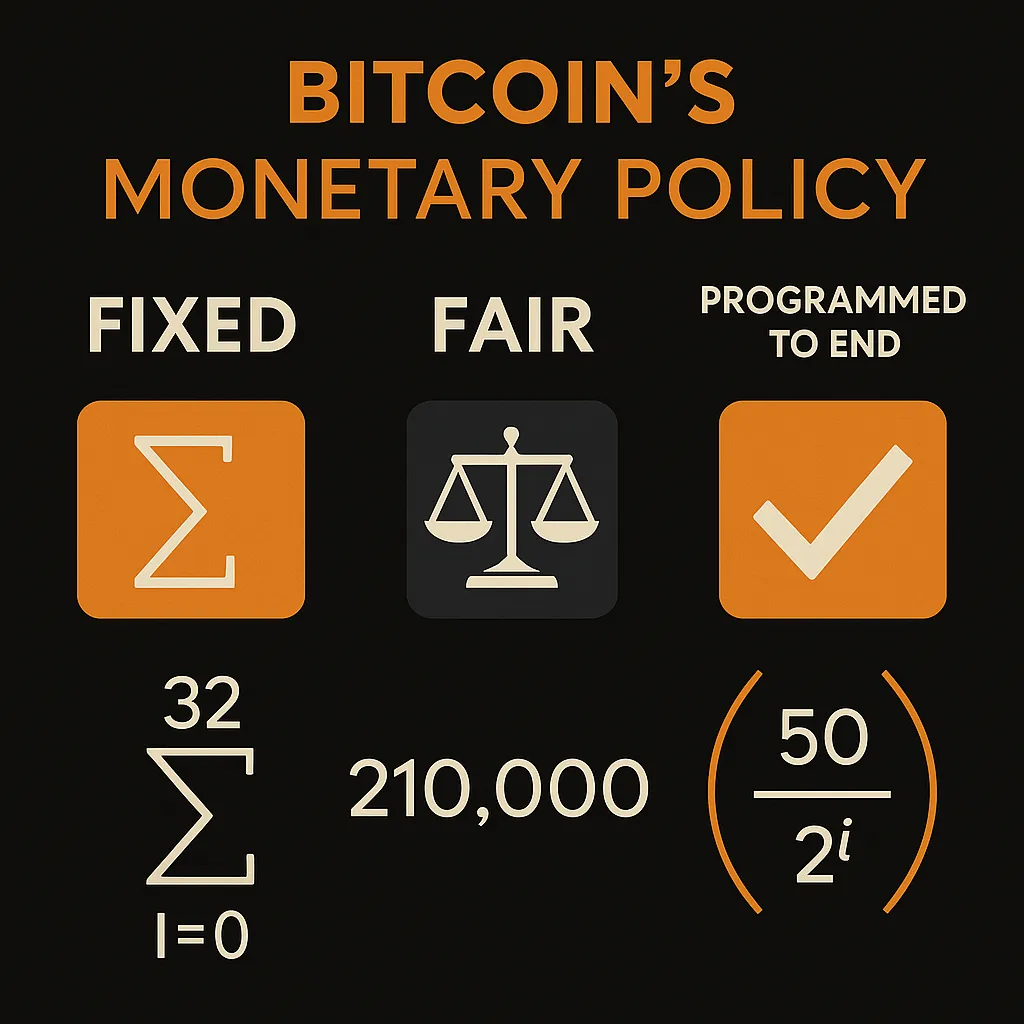

Bitcoin’s Monetary Policy: Fixed, Fair, and Programmed to End

At the core of Bitcoin’s revolutionary design is a simple yet profound monetary policy—predictable, transparent, and immune to political interference. The image above visually captures the elegant mathematics behind this policy. Let’s break it down.

The Fixed Supply: 21 Million BTC

Bitcoin is designed to have a maximum supply of 21 million coins, and this supply is not arbitrary—it’s the result of a carefully engineered issuance schedule baked into the protocol from day one. This is a stark contrast to fiat currencies like the U.S. dollar, which can be printed at will by central banks.

The issuance of new bitcoins happens through mining, where nodes (miners) validate transactions and secure the network. In return, they receive a block reward, which is the mechanism by which new bitcoins are introduced into circulation.

Understanding the Formula: Σ (210,000 * (50 / 2^i))

Let’s unpack the formula from the image piece by piece.

1. Genesis Block to Halving 32: Σ from i = 0 to 32

This summation (∑) starts from i = 0, representing the genesis block—Bitcoin’s very first block mined by Satoshi Nakamoto in January 2009. Each increment of “i” represents a halving, which occurs approximately every 210,000 blocks (roughly every four years).

Why 32? That’s the maximum number of times the block reward can be halved before it effectively reaches zero. After 32 halvings, the block subsidy becomes so small (less than one satoshi) that it mathematically rounds to zero in the Bitcoin protocol.

2. Block Reward Schedule: 50 / 2^i

Bitcoin started with a block reward of 50 BTC per block. Every 210,000 blocks, the reward is cut in half. The formula 50 / 2^i shows how the reward diminishes over time:

i = 0 → 50 BTC (Genesis to first halving)

i = 1 → 25 BTC

i = 2 → 12.5 BTC

i = 3 → 6.25 BTC

...

i = 32 → effectively 0 BTC

This reduction continues until new issuance stops entirely. This design ensures that the total supply asymptotically approaches—but never exceeds—21 million BTC.

3. 210,000 Blocks per Halving

Every 210,000 blocks, or roughly every 4 years, the reward is cut in half. This spacing controls the pace of Bitcoin’s issuance and mimics natural resource extraction, where the “easy” money is mined first and it becomes increasingly scarce over time.

Why It Matters: Deflation by Design

Bitcoin’s monetary policy contrasts sharply with the inflationary nature of fiat money. Central banks expand the money supply to stimulate the economy, but this often results in reduced purchasing power and hidden taxation through inflation.

Bitcoin, on the other hand:

Has a known and finite supply.

Reduces issuance over time in a predictable, coded schedule.

Removes the power of money creation from fallible humans or corrupt institutions.

Rewards early adopters while transitioning toward a fee-based incentive system as new issuance phases out.

From Block Rewards to Fee Market

Eventually, miners will no longer earn new bitcoins from block rewards and will rely entirely on transaction fees. By that point, Bitcoin’s economy is expected to be robust enough that securing the network through fees alone will be sustainable.

This transition is not a flaw—it’s a feature. Bitcoin’s policy is designed to bootstrap adoption with high rewards early on, while gradually moving toward long-term stability.

Final Thoughts

The beauty of Bitcoin’s monetary policy lies in its simplicity and immutability. It operates like clockwork. No elections, no backroom deals, no printing presses. Just pure math.

This image distills a revolution in monetary design into one elegant formula. Bitcoin doesn’t just offer a new kind of money—it offers a trustless, deflationary alternative to the chaos of central banking.

If that excites you, you're in the right place.

📥 Download our free guide to get started with Bitcoin today: bullishbtc.com/bitcoin-unlocked-a-guide-to-financial-sovereignty

Stay Bullish.

— Brought to you by BullishBTC.com