Bitcoin’s African Revolution: Stories of Everyday Impact

Simple Saturday – Bite-Sized Bitcoin Education + Lifestyle

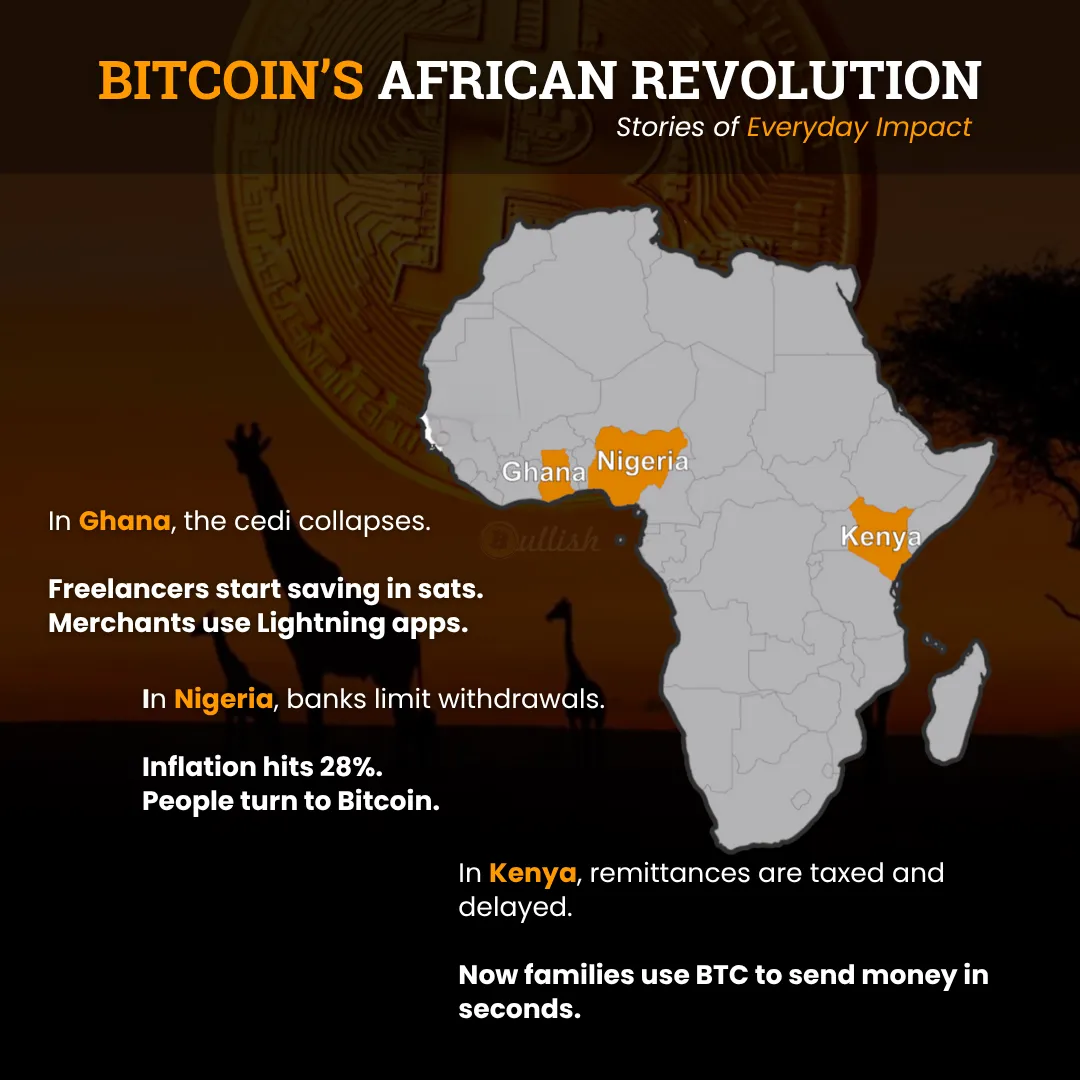

While Western media debates ETFs and price charts, something far more important is happening across Africa:

Bitcoin is solving real problems.

Nigeria: Bitcoin Beats the Bank

In Nigeria, inflation hit over 28% in 2024.

The government limited ATM withdrawals and pushed a failing central bank digital currency (eNaira). Citizens responded by turning to peer-to-peer Bitcoin markets.

No bank. No ID. No permission.

Just money that works.

Ghana: Inflation Hedge and Business Tool

As the Ghanaian cedi collapsed, Bitcoin became a savings strategy for freelancers, merchants, and tech workers.

People began using apps like Bitnob, Paxful, and Lightning wallets to earn and transact.

Bitcoin wasn’t just speculation.

It was survival.

Kenya: Cross-Border Payments Reinvented

Remittances are a lifeline across East Africa. But fees from Western Union and banks take a massive cut.

Enter Bitcoin.

Now, using Strike or Wallet of Satoshi, families can send money instantly—with no middlemen.

Faster. Cheaper. Borderless.

Why This Matters

In places with:

Currency controls

High inflation

Corrupt governments

Limited banking access

Bitcoin isn’t optional—it’s essential.

“Bitcoin fixes this” isn’t a meme in Africa.

It’s daily life.

If you want to go deeper into how Bitcoin is advancing human rights, especially across Africa, check out the incredible work in Check Your Financial Privilege by Alex Gladstein.

It’s filled with real voices from people using Bitcoin as a tool for survival, freedom, and dignity.

Bitcoin isn't just financial tech. It's human rights infrastructure.