Bitcoin vs. Fiat: The Three Money Functions Explained

What is Bitcoin Wednesday – Simple Explanations

When people ask, “Is Bitcoin real money?”

The answer depends on whether you know what money actually is.

Let’s break it down the right way—with clarity, not jargon.

Economists generally agree that for something to function as money, it must serve three roles:

Medium of exchange

Unit of account

Store of value

We’ll explain each in plain terms—and see how Bitcoin stacks up against fiat currency.

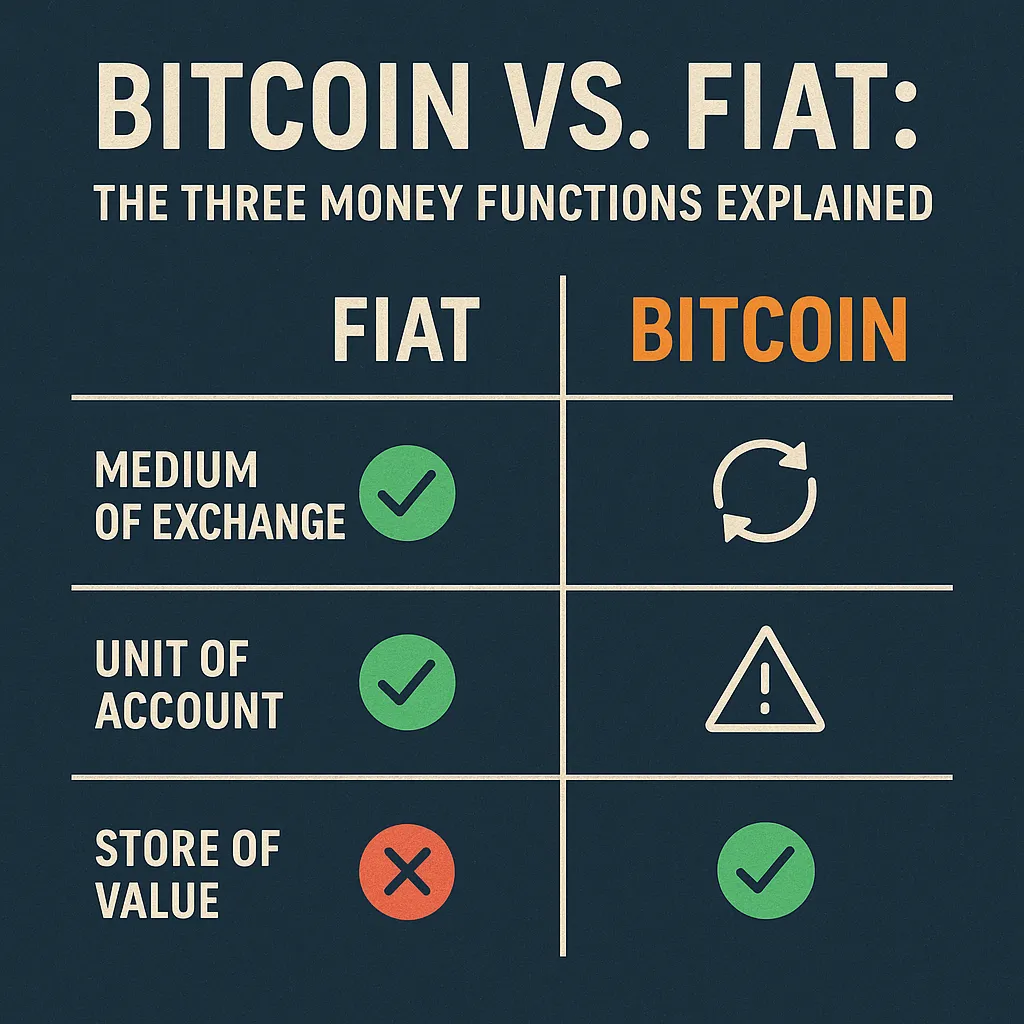

TL;DR – How Does Bitcoin Compare?

1. Medium of Exchange

“Can I use this to buy stuff?”

This is the most obvious purpose of money: a tool to trade with.

Right now, fiat currencies (like the U.S. dollar) dominate this category. They’re accepted nearly everywhere, used for groceries, gas, rent, and salaries. You can swipe, tap, or Venmo in seconds.

Bitcoin? It’s not quite there yet.

But it’s coming faster than most realize.

In 2024, more than 100,000 merchants accepted Bitcoin payments directly or through services like Strike, BitPay, or the Lightning Network. El Salvador even made it legal tender in 2021. Bitcoin is being used right now in places like Nigeria, Argentina, and Ukraine—not because it’s trendy, but because local currencies are collapsing.

💡 Bottom line:

Fiat wins for now in day-to-day exchange

Bitcoin is catching up, especially where fiat fails

As Lightning adoption grows, this gap shrinks fast

2. Unit of Account

“Can I use this to measure value?”

A unit of account means people use it to price things:

A soda costs $2

Rent is $1,500/month

A car is $25,000

Fiat currencies clearly dominate here too—because everything from real estate to stocks to groceries is still priced in dollars, euros, yen, etc.

Bitcoin? Not yet.

But it’s starting to show up in small pockets—like NFTs, some Bitcoin-only marketplaces, or among hardcore Bitcoiners who calculate everything in sats (1 BTC = 100,000,000 sats).

💡 Bottom line:

Fiat still wins in this category

But “unit of account” usually comes last in monetary adoption

If Bitcoin continues to grow as a store of value and medium of exchange, pricing in sats will follow

3. Store of Value

“Will this hold its worth over time?”

Here’s where Bitcoin flips the script.

The U.S. dollar has lost over 96% of its purchasing power since 1913. That’s not a bug. That’s how fiat works. Central banks intentionally devalue currencies over time to stimulate spending and manage debt.

If you saved $1,000 in cash 30 years ago, it buys far less today. That’s a bad store of value.

Now let’s look at Bitcoin.

Since 2009, Bitcoin has grown from $0.003 to over $60,000. Even with volatility, it has outpaced every fiat currency—and most assets.

Why?

Because:

There will only ever be 21 million BTC

New supply is cut in half every 4 years (the halving)

It’s impossible to “print more” or manipulate it like fiat

Bitcoin’s supply is fixed, but fiat supply expands infinitely. That makes Bitcoin deflationary over time—rewarding those who save in it.

💡 Bottom line:

Fiat is designed to lose value

Bitcoin is designed to preserve it

Bitcoin wins this category decisively

The Real Power Is in the Pattern

New monies rarely achieve all 3 functions at once.

Historically, the pattern goes like this:

Store of Value — people buy it to protect wealth (Gold, BTC)

Medium of Exchange — they begin using it in trade (Silver, BTC Lightning)

Unit of Account — they start pricing things in it (USD today… sats tomorrow?)

Bitcoin is following this exact pattern.

Right now, it’s crushing it as a store of value. The other two will come with time, infrastructure, and adoption.

Final Thought

You don’t need to use Bitcoin at the grocery store to understand why it matters.

You just need to understand what money really is.

If your dollars are losing value…

If your savings don’t feel safe…

If you’re tired of playing in a rigged monetary game…

Then Bitcoin isn’t speculation.

It’s salvation.

👊 Shout out to BullishBTC.com — Helping you understand Bitcoin in plain English, with real-world clarity.