DEBUNKING BITCOIN'S

MISCONCEPTIONS

DEBUNKING BITCOIN'S

MISCONCEPTIONS

Think Bitcoin is just for criminals or bad for the planet? Think again. This resource tackles the most common misconceptions with facts, data, and clear explanations—so you can separate fear from truth.

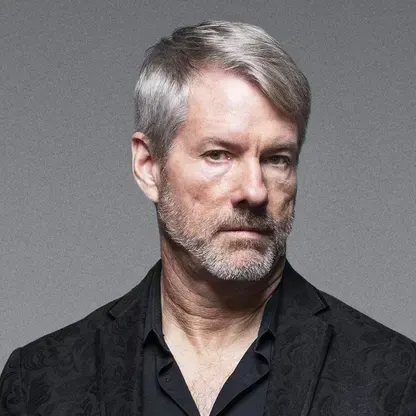

"Bitcoin isn’t backed by anything? It’s backed by math, code, and the energy securing the most powerful monetary network on Earth."

– Michael Saylor

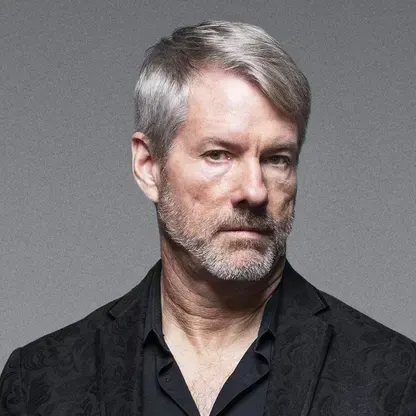

"Bitcoin isn’t backed by anything? It’s backed by math, code, and the energy securing the most powerful monetary network on Earth."

– Michael Saylor

Featured

“Bitcoin Is a Bubble”: Debunking the Lazy Take

Every time Bitcoin makes headlines, someone chimes in:

“It’s a bubble.”

“Just like tulips.”

“It’s bound to pop.”

The “bubble” critique is one of the most recycled and misunderstood takes in all of finance. It’s easy to say. It sounds smart. But it fails to grasp what Bitcoin actually is—and how monetary assets evolve.

So let’s set the record straight.

1. What Is a Bubble, Really?

A financial bubble happens when the price of an asset detaches wildly from its intrinsic value, fueled by speculation, hype, and FOMO—until it bursts.

Think:

Beanie Babies

Dot-com stocks with no revenue

Housing with no income backing

But here’s the question: What’s Bitcoin’s “intrinsic value”?

Most critics can’t answer that—because they’re still thinking in terms of stocks or commodities.

But Bitcoin isn’t either. It’s money.

And money doesn’t have value because of cash flow or use cases. It has value because people believe in it and use it.

2. Money Is the Ultimate Network Effect

Monetary assets are different.

They follow a unique lifecycle: monetization.

They start as collectibles. They gain believers. Liquidity builds. Price rises. More adopt. Eventually, they become money.

This happened with gold. It’s happening again with Bitcoin.

In fact, every “bubble” Bitcoin has gone through has brought in a wave of new users, stronger infrastructure, and deeper liquidity.

That’s not a burst. That’s adoption.

3. Bitcoin Has Survived Over a Dozen “Pops”

Since 2009, Bitcoin has “died” hundreds of times.

It’s been called a bubble at $1... then $10... then $100... then $1,000... and again at $69,000.

Each time it crashes, critics say, “See? Told you it was a bubble.”

And each time, it doesn’t die—it gets stronger.

No true bubble comes back stronger after popping. But Bitcoin always does.

That’s not a bug. That’s monetary evolution.

4. The Tulip Comparison Is Lazy

Tulip bulbs peaked in 1637... then never recovered.

That’s not Bitcoin.

Bitcoin has:

100% uptime since launch

A fixed supply of 21 million

A global network of millions of users

Billions in security infrastructure

Decentralization with no single point of failure

Tulips didn’t have lightning wallets, hardware security, or cryptographic consensus.

Comparing Bitcoin to tulips is like comparing the internet to fax machines.

5. Price Volatility ≠ a Bubble

Bitcoin is volatile—no argument there.

But volatility is not proof of a bubble. It’s proof of price discovery in a free, global market. Every major asset class went through similar swings in its early days.

Amazon stock dropped 90% in 2001.

The internet faced years of skepticism.

Even the U.S. dollar had wild swings in its infancy.

Volatility isn’t disqualifying—it’s inevitable in early adoption.

6. Bitcoin Is Not Priced Like a Stock—It’s Priced Like a New Language

Bitcoin is a new language for value. A new ledger for trust. A new foundation for global settlement.

Its price reflects belief in a different future: one without central banks, money printers, or politicized finance.

If that’s a bubble, it’s the most resilient one ever created.

Conclusion: It's Not a Bubble—It’s a Base Layer

Bitcoin isn’t a pet rock. It’s not a tulip. It’s not a scam.

It’s the world’s first truly scarce, decentralized, digital monetary asset—and it’s still early in its monetization curve.

Calling it a bubble isn’t analysis. It’s a refusal to look deeper.

So next time someone drops the lazy take, you’ll know what to say:

“It’s not a bubble. It’s a base layer.”

Shout out to BullishBTC.com — where we pop fiat myths and explain Bitcoin with clarity and conviction.

Bitcoin Common Misconceptions w/ Robert Breedlove (BTC001)

How Money & Banking Work (& why they're broken today) - Lyn Alden

Government Bans And Regulations On Bitcoin | Debunking every Bitcoin "Problem" Ever

OUR GOAL

Our goal is to educate others on the value of owning Bitcoin from both a financial and humanitarian perspective.

QUICK LINKS

© 2025, BullishBTC. All rights reserved.