ENVIRONMENTAL CASE

for BITCOIN

ENVIRONMENTAL CASE

for Bitcoin

Explore a curated collection of articles, videos, and research that dive into Bitcoin’s environmental impact, energy use, and sustainability efforts.

“Energy use is not a flaw of Bitcoin—it’s what gives it strength, security, and independence.”

– Lyn Alden

“Energy use is not a flaw of Bitcoin—it’s what gives it strength, security, and independence.”

– Lyn Alden

Featured

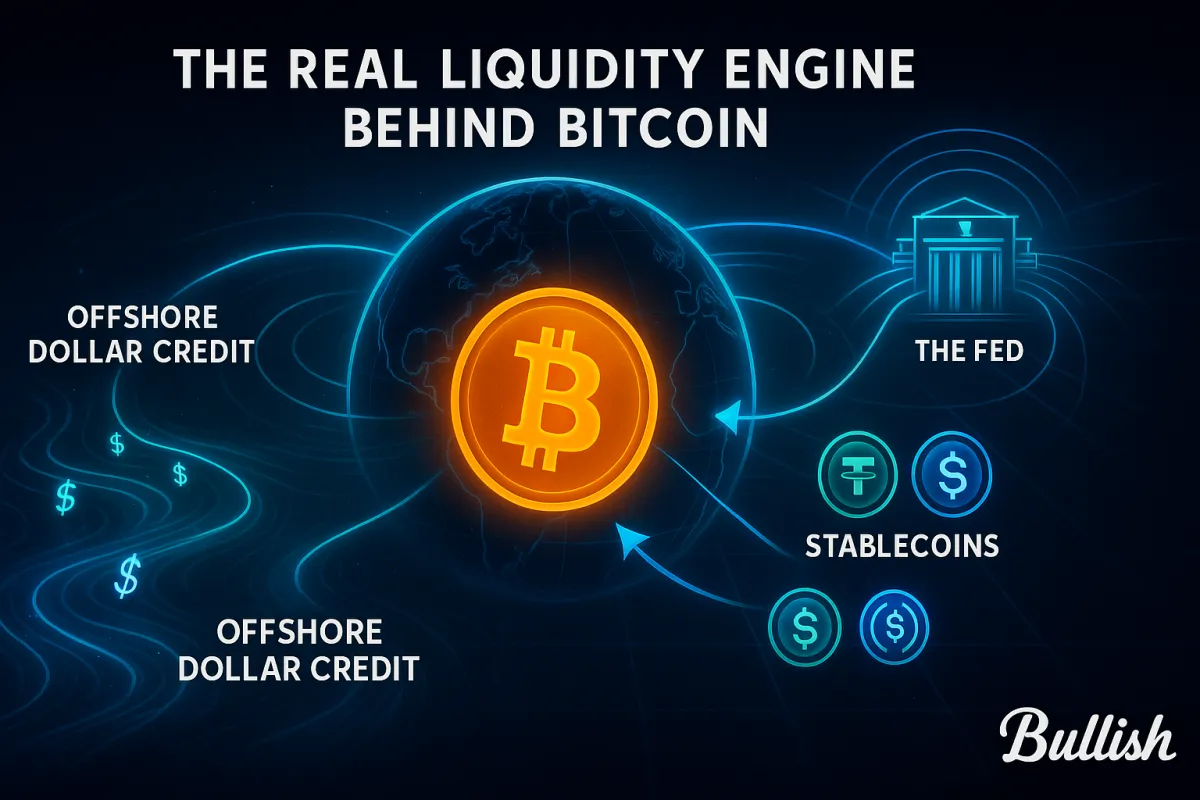

A Four-Part Deep Dive Into How Global Liquidity Shapes Bitcoin

Overview

Bitcoin doesn’t move randomly, it pulses with the flow of global liquidity.

This BullishBTC series breaks down how the dollar system, stablecoins, and Federal Reserve policy all feed into Bitcoin’s market cycles, revealing why Bitcoin has become the world’s most sensitive liquidity signal.

Each part stands alone yet fits into one complete narrative about the future of sound money in an over-leveraged world.

🔹 Part 1 – How Offshore Dollar Credit Works

Global finance runs on offshore dollar credit, money created outside the U.S. banking system through the Eurodollar market.

When offshore credit expands, liquidity floods risk assets like Bitcoin. When it contracts, liquidity vanishes.

Understanding these unseen dollar flows reveals why Bitcoin’s bull and bear markets mirror global liquidity cycles.

Key idea: Bitcoin’s price rises and falls with the expansion and contraction of offshore dollar credit.

🔹 Part 2 – Stablecoins: The Rise of Synthetic Eurodollars

Stablecoins like USDT and USDC are digital Eurodollars: private, offshore dollar liabilities moving at internet speed.

Their supply expands when risk appetite rises and contracts during stress, directly influencing Bitcoin’s liquidity.

They’re not separate from the dollar system—they are the newest form of it.

Key idea: Stablecoins bridge traditional dollar credit and crypto, transmitting global liquidity straight into Bitcoin markets.

🔹 Part 3 – The Fed’s Role in Global Liquidity

The Federal Reserve is the world’s liquidity engine, controlling the global cost of dollars through QE, QT, and swap lines.

Every policy shift, tightening or easing, reverberates through offshore markets and into Bitcoin’s price.

When the Fed prints, Bitcoin pumps; when it drains liquidity, Bitcoin bleeds.

Key idea: Bitcoin’s market cycles are reflections of the Fed’s global liquidity pulse.

🔹 Part 4 – Bitcoin as the Global Liquidity Sensor

Bitcoin has become a real-time barometer of global liquidity.

Because it trades 24/7 and globally, it reacts faster than any other asset to changes in dollar credit and central bank policy.

As adoption grows, Bitcoin may evolve from reflecting liquidity to defining it, becoming the foundation of a proof-based monetary system.

Key idea: Bitcoin is the world’s most transparent liquidity sensor, and potentially the base layer of tomorrow’s financial system.

📚 Series Index

1️⃣ Part 1 – How Offshore Dollar Credit Works

2️⃣ Part 2 – Stablecoins: The Rise of Synthetic Eurodollars

3️⃣ Part 3 – The Fed’s Role in Global Liquidity

4️⃣ Part 4 – Bitcoin as the Global Liquidity Sensor

Closing Thoughts

Bitcoin was born from distrust in the fiat system, but its price still dances to the rhythm of global liquidity.

By tracing those flows, we see Bitcoin not as an anomaly, but as a mirror of the monetary order it’s slowly replacing.

For deeper insights and Bitcoin education grounded in sound money principles, visit BullishBTC.com.

Introducing Soluna’s Project Dorothy: A Wind-Powered Data Center in Texas

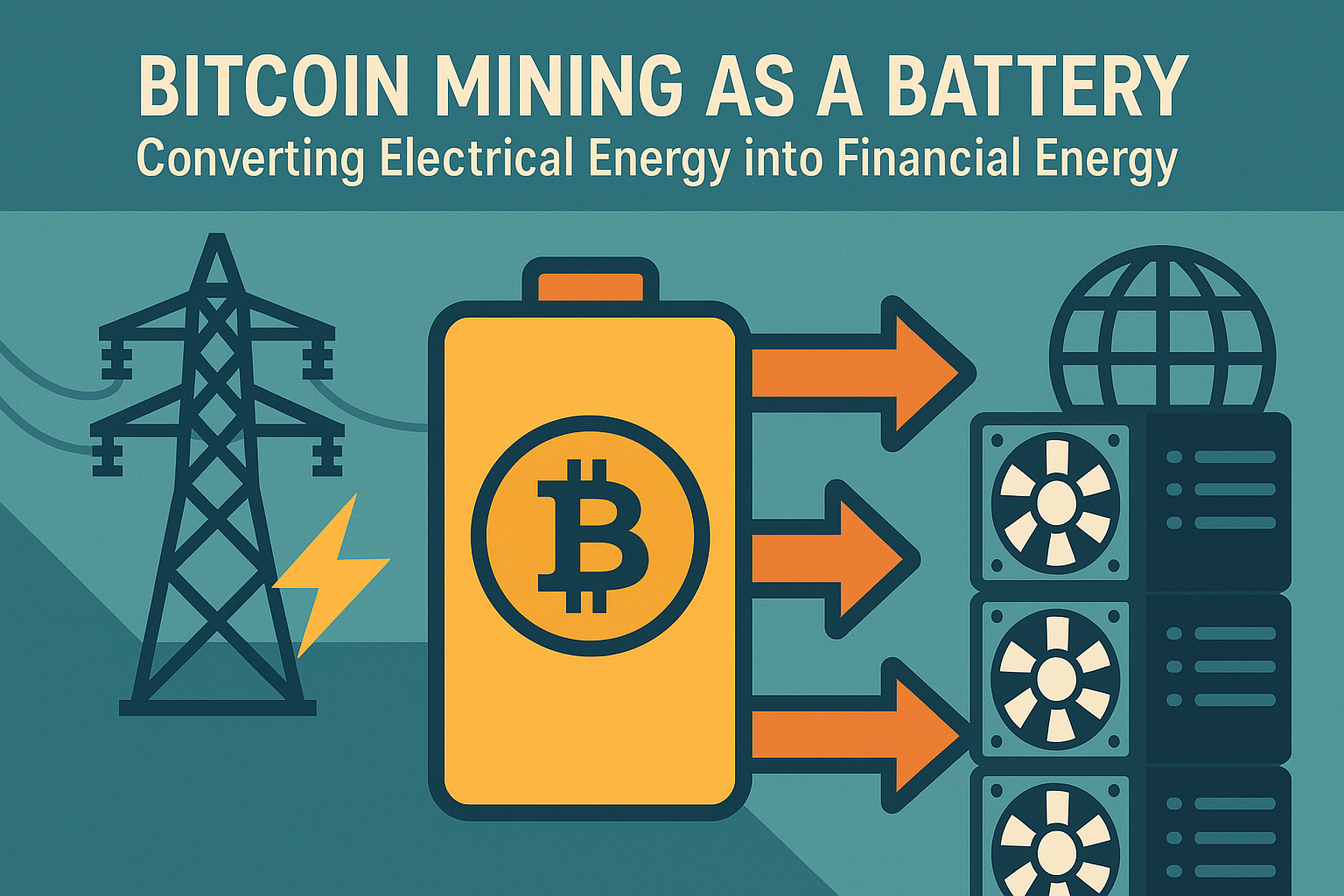

Bitcoin Mining: Separating Fact from Fiction

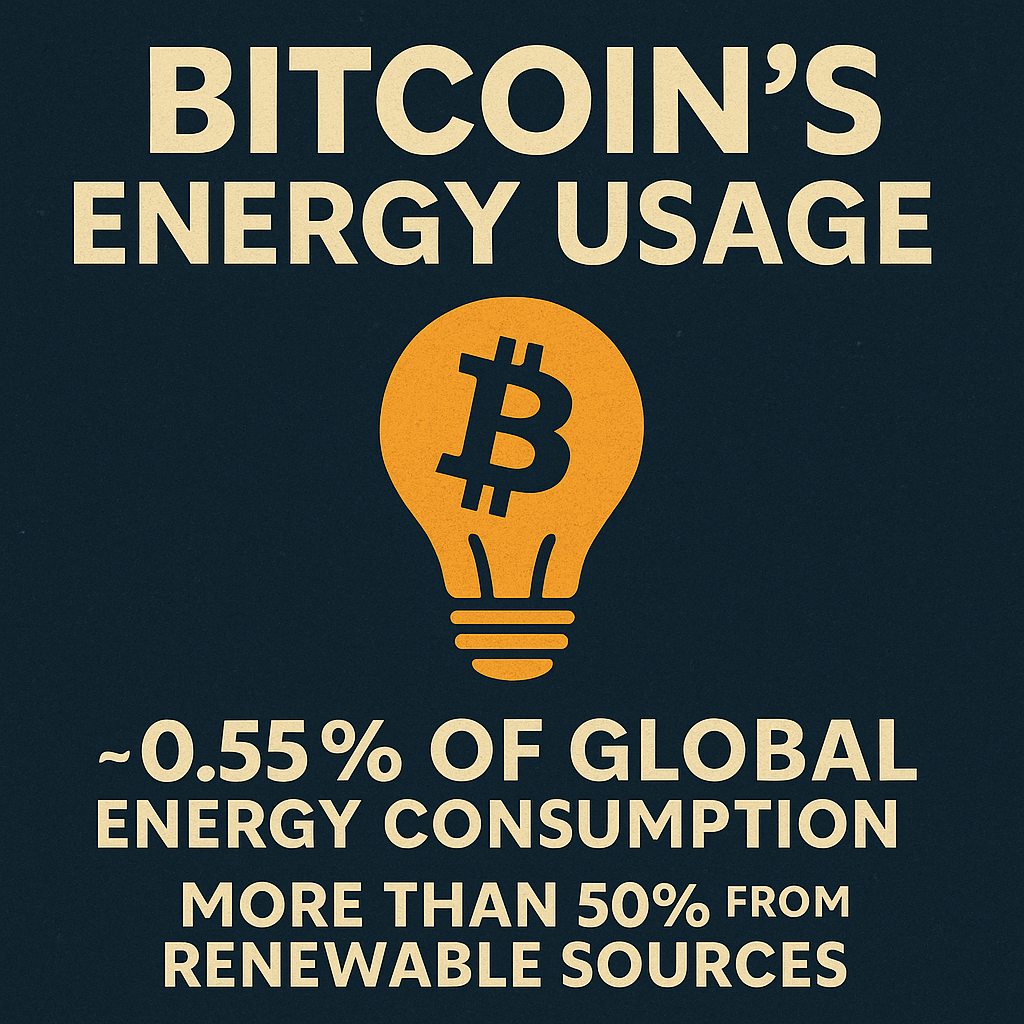

Bitcoin's Energy Consumption and its Environmental Impact

How Bitcoin Can Expand the Grid in Africa with Erik Hersman

Turning Garbage into Bitcoin with Adam Wright

Builders + Innovators Summit 2021: Crusoe Energy

OUR GOAL

Our goal is to educate others on the value of owning Bitcoin from both a financial and humanitarian perspective.

QUICK LINKS

© 2025, BullishBTC. All rights reserved.